by David M. Craig

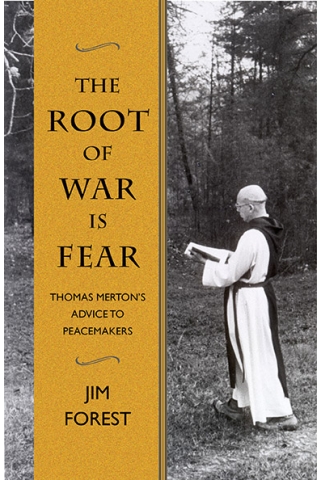

Dustwrapper art courtesy Orbis Books; orbisbooks.com

Jim Forest has written a deeply personal book, The Root of War Is Fear: Thomas Merton’s Advice to Peacemakers (Maryknoll, NY: Orbis Books, 2016). It is personal in two ways. First, the book is a memoir of Forest’s encounters with Merton during the 1960s. A co-founder of the Catholic Peace Fellowship and former managing editor of The Catholic Worker, Forest stumbled upon Merton’s spiritual autobiography The Seven Storey Mountain in late 1959 when he was still in the United States Navy. Up until Merton’s untimely death in 1968, Forest corresponded with Merton and visited him at his Trappist monastery in Kentucky. The book’s chapters proceed chronologically, weaving substantial excerpts from Merton’s writings on peace and war into an assessment of his intellectual, moral, and spiritual significance for the Catholic Church, peace activists, and Forest himself.

Second, the book locates the beating heart of Merton’s transformative influence in a Christian personalism. This theology affirms that every person is God’s child, while revealing each person as woefully self-justifying yet still redeemed in Jesus Christ. Merton’s theology manifests in vivid flashes of writing, not abstract doctrinal statements like this one. For example, Merton decided to intervene more publicly in contemporary debates following his 1958 epiphany on a Louisville street corner. Merton recounts how the “illusory difference” of human separateness vanished in a rush of unbounded joy that “God Himself gloried in becoming a member of the human race.” He continues, “There is no way of telling people that they are all walking around shining like the sun… There are no strangers… If only we could see each other [as we really are] all the time. There would be no more war, no more hatred, no more cruelty, no more greed… I suppose the big problem is that we would fall down and worship each other.” (17-18, ellipses and brackets are Forest’s.)

Read the rest of this article »

by Pontifical Council for Inter-religious Dialogue

Nonviolence logo courtesy clipartkid.com

Editor’s Preface: On the occasion of the Buddhist feast of Vesakh, the Vatican issued the message that follows. Vesakh commemorates the Buddha’s birth, enlightenment, and death, and is often referred to as “Buddha’s Birthday.” This is one in a series of recent statements the Vatican, and Pope Francis, have made on nonviolence. Please see Pope Francis’s statement, also posted here, and please see the note at the end for the names of the signatories, links, and acknowledgments. JG

Message for the Feast of Vesakh, 2017

Dear Buddhist Friends,

(1) In the name of the Pontifical Council for Inter-religious Dialogue, we extend our warmest greetings and prayerful good wishes on the occasion of Vesakh. May this feast bring joy and peace to all of you, to your families, communities and nations.

Read the rest of this article »

by War Resisters League

Dustwrapper art courtesy www.warresisters.org

Refusing to pay taxes for war is probably as old as the first taxes levied for warfare. We offer below a summary of such protest, which is to say it does not include other forms of tax refusal and resistance, a common tactic in worldwide labor movements, for example, or in various anti-colonial protests including such well-known examples as the Boston Tea Party.

Indeed, until World War II, war tax resistance in the U.S. manifested itself primarily among members of the historic peace churches — Quakers, Mennonites, and Brethren — and usually only during times of war. There have been instances of people refusing to pay taxes for war in virtually every American war, but it was not until World War II and the establishment of a permanent, centralized U.S. military (symbolized by the building of the Pentagon) that the modern war tax resistance movement was born.

Colonial America

One of the earliest known instances of war tax refusal took place in 1637 when the relatively peaceable Algonquin Indians opposed taxation by the Dutch to help improve their local Fort Amsterdam. Shortly after the Quakers arrived in America (1656) there were a number of individual instances of war tax resistance. For example, in 1709 the Quaker Assembly refused a request of £4000 for a military expedition into Canada, replying, “It is contrary to our religious principles to hire men to kill one another.”

Read the rest of this article »

by Lawrence Rosenwald

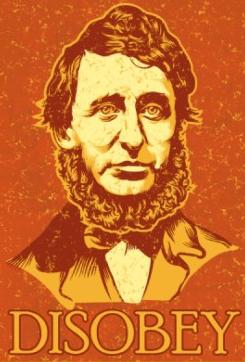

Poster art of Thoreau courtesy pinterest.com

Doing tax resistance has for me been connected with thinking about Thoreau, whose works I often teach in my classes. I used not to teach “Civil Disobedience,” but only Walden; although I admired “Civil Disobedience” very much, but couldn’t bring myself to teach it. It is an essay intended as an argument; I knew that if I taught it I would present it as an argument, as an argument I found reasonable and compelling, and then, I thought, some alert and nervy student would ask, “If you think it’s such a good argument then why are you paying your taxes?” And then I’d either mutter something about how times have changed, or say I was a coward, and I knew I wouldn’t like myself in either case. But when my wife and I began doing tax resistance, I began to teach “Civil Disobedience,” and in fact teaching it — not proselytizing with it, but teaching it on a footing of equality — is among the rewards doing tax resistance has brought me.

So I want to talk about Thoreau, first, and about the ideas his tax resistance came from; and then about myself, as someone who finds Thoreau’s stance attractive but who knows that, after all, times have changed, and that doing tax resistance now is different from doing it then, and grimmer; and generally about why so many people with political views similar to mine don’t find Thoreau attractive or at any rate don’t do tax resistance, and how this can perhaps be changed.

Read the rest of this article »

by National War Tax Resistance Coordinating Committee

Poster art courtesy nwtrcc.org

Editor’s Preface: This article continues our series of statements of purpose by various nonviolence organizations. The National War Tax Resistance Coordinating Committee (NWTRCC) is a coalition of U.S. local, regional, and national groups and individuals supporting, as they state, “individuals who refuse to pay for war, and promoting U. S. war tax resistance in the context of a broad range of nonviolent strategies for social change.” Their website is a primary source of information on war tax resistance, including tactics and legal consequences. Please see the note at the end for acknowledgments, further information, and links. JG

What is War Tax Resistance?

War tax resistance means refusing to pay some or all of the federal taxes that pay for war. While you can refuse income tax legally by lowering your taxable income, for many people war tax resistance involves civil disobedience. In the U.S. war tax resisters refuse to pay some or all of their federal income tax and/or other taxes, such as the federal excise tax on local telephone service. Income taxes and excise taxes are destined for the government’s general fund and about half of that money goes for military spending, including weapons of war and weapons of mass destruction. Through the redirection of our tax dollars, war tax resisters contribute directly to the struggle for peace and justice.

Read the rest of this article »

by Mark Engler and Paul Engler

“Gandhi Takes Salt”; Sabarmati Ashram mural photo courtesy blogeswara.wordpress.com

At the end of 1930, India was experiencing disruption on a scale not seen in nearly three quarters of a century — and it was witnessing a level of social movement participation that organizers who challenge undemocratic regimes usually only dream of achieving.

A campaign of mass non-cooperation against imperial rule had spread throughout the country, initiated earlier that year when Mohandas Gandhi and approximately 80 followers from his religious community set out on a Salt March protesting the British monopoly on the mineral. Before the campaign was through, more than 60,000 people would be arrested, with as many as 29,000 proudly filling the jails at one time. Among their ranks were many of the most prominent figures from the Indian National Congress, including politicians that had once been reluctant to support nonviolent direct action.

Read the rest of this article »

by David Gross

Dustwrapper art courtesy David Gross; sniggle.net/TPL/index5.php

Editor’s Preface: This article was written in March 2003 as a response to the U.S. invasion of Iraq. David Gross went on to become a leading figure in the tax resistance movement. Please see his compilation of John Woolman’s writings, previously posted here, and see also the note at the end for further information, acknowledgments, and links. JG

When the war in Iraq started, [March 20, 2003] and especially when it escalated into a full-blown invasion, I gave notice at work. My intention was to reduce my income below the threshold of taxation so as to stop paying income tax to the U.S. government. I’m writing this to explain myself to my friends, who will notice a bit of a change of lifestyle in me in the coming months. Also, I write because writing calms my nerves, and I’m a bit nervous about this. I’m starting on an experiment, and I’m not sure where it will take me.

I take on faith the philosophical speculation that each of us has free will. It does seem that a lot of the evidence lately has been going in the other direction, but that doesn’t stop me. If I’m right, I have the opportunity to try my hand at the controls. If I’m wrong, I couldn’t change my mind if I wanted to, no?

Read the rest of this article »

by David Hartsough, Kit Miller, Michael Nagler, Miki Kashtan, Ruth Benn

Poster art courtesy National War Tax Resistance Coordinating Committee; nwtrcc.org

Editor’s Preface: The letter reproduced below is a joint appeal from leading nonviolent activists and organizations, urging US taxpayers to nonviolently express their opposition to the policies of the Trump administration by refusing to pay a symbolic amount of their US federal income tax, and instead donate that amount to a deserving charity or institution. This method of nonviolent civil resistance has many historical precedents in the U.S., most notably the Quaker John Woolman’s 18th century statements, which we previously posted. JG

Dear Friends,

We are writing to ask you to do something that you probably have never done in your life. This is a historical moment you can be an active part of shaping.

We all know the stories of people who committed atrocities and said, in their defense, that they were following orders.

Read the rest of this article »

by David Gross

Dustwrapper art courtesy David Gross; sniggle.net/TPL/index5.php

Editor’s Preface: Tax resistance is one of the oldest nonviolent tactics, some citing a Jewish Zealot Revolt of c. 60-70 CE as the first. We are inaugurating our new series on the subject with this article about the 18th century Quaker, John Woolman. His call to conscience was one of the more influential texts on early American civil disobedience and resistance. If anything tax resistance is now not only more relevant, but more prevalent. We are posting two versions of John Woolman’s tax resistance writings; the first reproduces the original journal entries, and retains, therefore, Woolman’s spelling and grammar, with exceptions in square brackets. The second, Harvard Classics version, modernizes the language. JG

The American Quaker John Woolman (1720-1772) was a pioneer of conscientious tax resistance, and he has left a record of how he wrestled with his conscience over whether or not to pay taxes for the French and Indian War. (1) As he wrote, “To refuse the active payment of a Tax which our Society generally paid, was exceedingly disagreeable; but to do a thing contrary to my Conscience appeared yet more dreadfull . . . I knew of none under the like difficulty, and in my distress I besought the Lord to enable me to give up all, that so I might follow him wheresoever he was pleased to lead me.” (2)

Read the rest of this article »

by Robert Levering

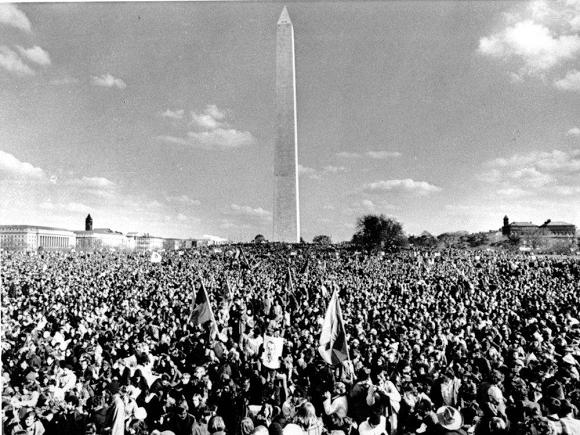

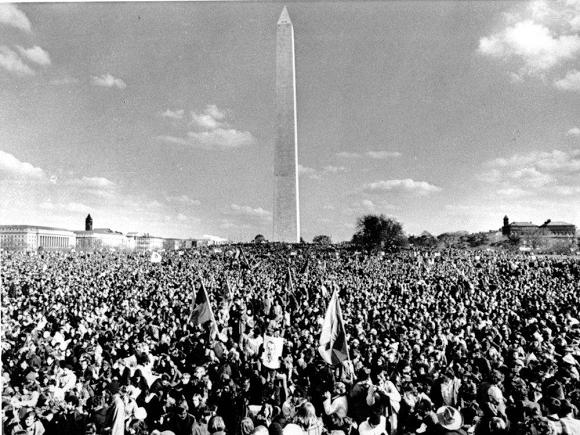

Anti-Vietnam War rally at Washington Monument, Nov. 1969; courtesy npr.org

Only the Vietnam era protests match the size and breadth of the movement unleashed by the election of Donald Trump. One point of comparison: The massive march and rally against the Vietnam War in 1969 was the largest political demonstration in American history until the even more massive Women’s March on January 23. All around us we can see signs that the movement has only just begun. Consider, for instance, that a large percentage of those in the Women’s March engaged in their very first street protest. Or that thousands of protesters spontaneously flocked to airports to challenge the anti-Muslim ban. Or that hundreds of citizens have confronted their local congressional representatives at their offices and town hall meetings about the potential repeal of Obamacare and other Trump/Republican policies.

Read the rest of this article »